FREOPP

January 16, 2019

One of the greatest challenges to affordable health care is the high cost of American hospitals. The most important driver of higher prices for hospital care, in turn, is the rise of regional hospital monopolies. Hospitals are merging into large hospital systems, and using their market power to demand higher and higher prices from the privately insured and the uninsured.

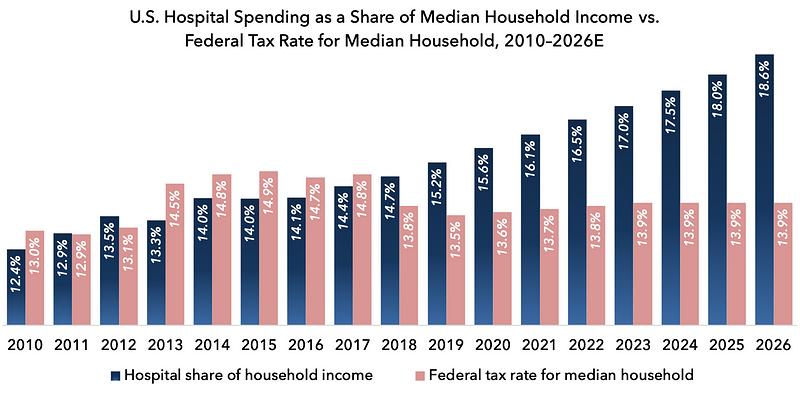

In 2018, Americans spent nearly $1.2 trillion on hospital care, representing approximately $9,200 for the median household, or 14.7 percent of median household income. That exceeds what the average family paid in federal income and payroll taxes. By 2026, projected hospital spending will exceed $13,000 per household: nearly one-fifth of household income.

Among the industrialized member countries of the OECD, the median hospital stay cost $10,530 and lasted 7.8 days in 2014. In the United States, the average hospital stay cost $21,063, despite lasting only 6.1 days. In other words, the average daily cost of a hospital stay in the U.S. was 2.6 times that of the OECD average of industrialized nations.

In 2011, James Robinson of the University of California reviewed hospital prices charged to commercial insurers for six common procedures: angioplasty, pacemaker insertion, knee replacement, hip replacement, lumbar fusion, and cervical fusion. He found that, on average, procedures cost 44 percent more in hospital markets with an above-average degree of consolidation.

It is problematic enough that regional hospital monopolies have the power to demand high prices. But on top of this, many hospitals engage in additional anticompetitive practices. Anna Wilde Mathews of the Wall Street Journal obtained secret contracts between insurers and hospitals revealing that these contracts often barred insurers from sending patients to “less-expensive or higher-quality health care providers.” Other hospitals precluded insurers from excluding some of the system’s hospitals from the insurer’s networks. Some contract provisions, including those from New York-Presbyterian Hospital and BJC HealthCare of St. Louis, prevented insurers from disclosing a hospital’s prices to patients.

Sometimes, states have been willing to take on the role of enforcing anticompetitive contracts. Many states have enacted any willing provider laws that require insurers to contract with every hospital in the state, regardless of what prices each hospital charges. Other states use network adequacy requirements to achieve a similar effect: forcing insurers to contract with large hospitals because doing so helps ensure that an insurer’s patients have enough hospital options. But restricting insurers’ ability to exclude high-cost hospitals from their provider networks limits their bargaining ability, and allows hospitals to charge higher prices.

This paper proposes several steps to improve hospital competition, thereby reducing the cost and improving the quality of hospital care.

The centerpiece is a proposal to eliminate the ability of regional hospital monopolies to engage in exploitative pricing practices, by capping reimbursement rates for private and individual payors at Medicare rates in extremely concentrated hospital markets, as measured by the Herfindahl-Hirschman Index, a widely-used measure of market concentration. The Medicare ceiling would not apply in competitive hospital markets, nor upon hospitals with less than 15 percent share in a given market.

Unlike antitrust enforcement from federal and state entities, this proposal would help address the problem of consolidation that has already happened, by giving regional hospital monopolies a choice: either remain consolidated but without exploitative pricing power, or voluntarily divest and restore a competitive provider market. No longer would hospitals merge for the sole purpose of increasing their pricing power: something that has been all too common over the past several decades.

We also propose:

- Discouraging future hospital mergers by significantly expanding the Federal Trade Commission’s hospital antitrust staff, allowing the FTC to regulate anticompetitive practices by nonprofit hospitals, and publishing — on a quarterly basis — data for every ZIP code or region regarding hospital market concentration.

- Encouraging new hospital competition by encouraging states through federal grants to eliminate certificate of need laws, any willing provider laws, network adequacy requirements, certificate of public advantage laws, and similar provisions; removing the Affordable Care Act’s ban on new physician-owned hospital construction; and barring the deployment of hospital-led accountable care organizations in concentrated markets;

- Facilitating medical tourism and telemedicine through harmonization of state medical licensing, reference pricing, and scope of practice laws; and

- Integrating Veterans Health Administration hospitals into the broader health care system by allowing private patients to use VA hospitals, and by allowing VA hospitals to compete on price with non-VA hospitals.

Among policymakers in Washington, interest in the problem of hospital consolidation is rising. In January of 2019, Indiana Rep. Jim Banks (R.) introduced the Hospital Competition Act of 2019, which reflects most of the concepts described in this paper. Additional legislative and regulatory measures are also under development. Rep. David Cicilline (D., R.I.), who chairs the antitrust subcommittee of the House Judiciary Committee, has stated that hospital consolidation is one of his top priorities. The Trump administration has also expressed support for changes that would improve hospital competition.

Improving hospital competition will not only reduce the cost of U.S. health care, but also spur innovations in quality, patient service, and technology. Most importantly, it is a necessary step in building a health care system that is affordable for all Americans, and fiscally sustainable for future generations.